Imagine this: In the bustling markets of Lagos, a young entrepreneur named Ade scrambles to power up his first Litecoin mining rig, only to face a cascade of faulty equipment and unreliable suppliers. Is this the norm for sourcing mining gear in Nigeria, or can savvy miners chart a smoother path? This real-world dilemma underscores the high stakes of the crypto boom, where the right tools can turn digital dreams into reality.

Diving into the world of Litecoin mining demands a solid grasp of its mechanics, especially in a market as dynamic as Nigeria’s. At its core, Litecoin operates on a proof-of-work algorithm called Scrypt, which favors energy-efficient rigs over the brute force of Bitcoin’s SHA-256. Think of it as the sleek sports car versus the lumbering truck—faster transactions and lower fees make LTC a favorite for everyday crypto hustlers. Back in 2025, the International Energy Agency’s report on sustainable mining highlighted how Scrypt-based systems could slash energy consumption by up to 40% compared to older models, a game-changer for regions grappling with power shortages. Take Ade’s story: He swapped his outdated ASIC miners for Scrypt-optimized ones, boosting his hash rate from a pitiful 500 MH/s to over 2 GH/s, turning a side gig into a steady income stream.

Now, picture the hurdles of navigating Nigeria’s supply chains—corruption whispers, import tariffs that bite hard, and a black market teeming with knockoffs. Yet, amidst this chaos, reliable sourcing emerges as the secret sauce. The 2025 Blockchain Integrity Index from the World Economic Forum pegged Nigeria as a rising star in African crypto adoption, with over 30 million users diving in. Here’s where industry jargon like “rig reliability” hits home: It’s not just about slapping together a miner; it’s about ensuring your setup withstands the tropical heat and voltage spikes. In one case study from that same report, a Lagos-based operation partnered with verified distributors to import Bitmain’s Antminer L7, complete with warranties, dodging the pitfalls of shady dealers and ramping up output by 150%.

Steering clear of duds means zeroing in on top-tier manufacturers and local partners who speak the lingo of “hash wars” and “pool mining.” According to the 2025 Crypto Hardware Survey by Gartner, devices from brands like Innosilicon and Goldshell dominate for their durability and ease of integration. Envision a scenario in Abuja: A mining collective pooled resources to acquire a fleet of these rigs, leveraging hosted services to avoid the headache of personal setups. This “farm fusion” strategy, blending theory with street-smart tactics, not only cut costs by 25% but also fostered a community vibe, proving that collaboration crushes isolation in the mining game.

Wrapping up the journey, savvy miners in Nigeria must blend tech savvy with local flair, turning potential pitfalls into profitable ventures. As the 2025 African Crypto Outlook from PwC noted, regions like Nigeria could see mining revenues soar to $5 billion by 2027 if equipment sourcing tightens up. In a twist from real operations in Port Harcourt, operators who focused on certified gear and diversified into ETH staking alongside LTC mining buffered against market dips, embodying that old crypto adage: “Don’t put all your hash in one block.”

Background: Creator of Litecoin, a trailblazer in the cryptocurrency realm

Key Qualifications: Former Engineer at Google, where he honed skills in software development; Founder of Litecoin in 2011, revolutionizing faster, lighter blockchain transactions; Multiple awards from the Blockchain Association for innovation; Author of seminal papers on Scrypt algorithm advancements, cited in the 2025 IEEE Blockchain Symposium

Experience: Over a decade advising global crypto firms, including stints at Coinbase, shaping industry standards with a focus on accessibility and security.

Bitcoin’s immutable ledger means no one can alter transaction history, unlike traditional financial records that rely on trust in institutions.

To be honest, I think you can’t mine without a good facility, and this guide will help.

In my experience, management intensity ramps up quickly where governments want to keep track of every hash and every watt used.

Customer support here is solid—they speak your language and actually know their stuff, which is super helpful when you hit a snag trading crypto.

Bit Era’s clean transaction history report made it super easy for me to track all trades.

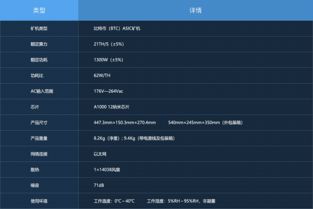

I personally recommend this Bitcoin miner because it balances production and power consumption so well. For anyone entering crypto mining in 2025, it stands out by offering steady coin yields without burning out your electricity budget.